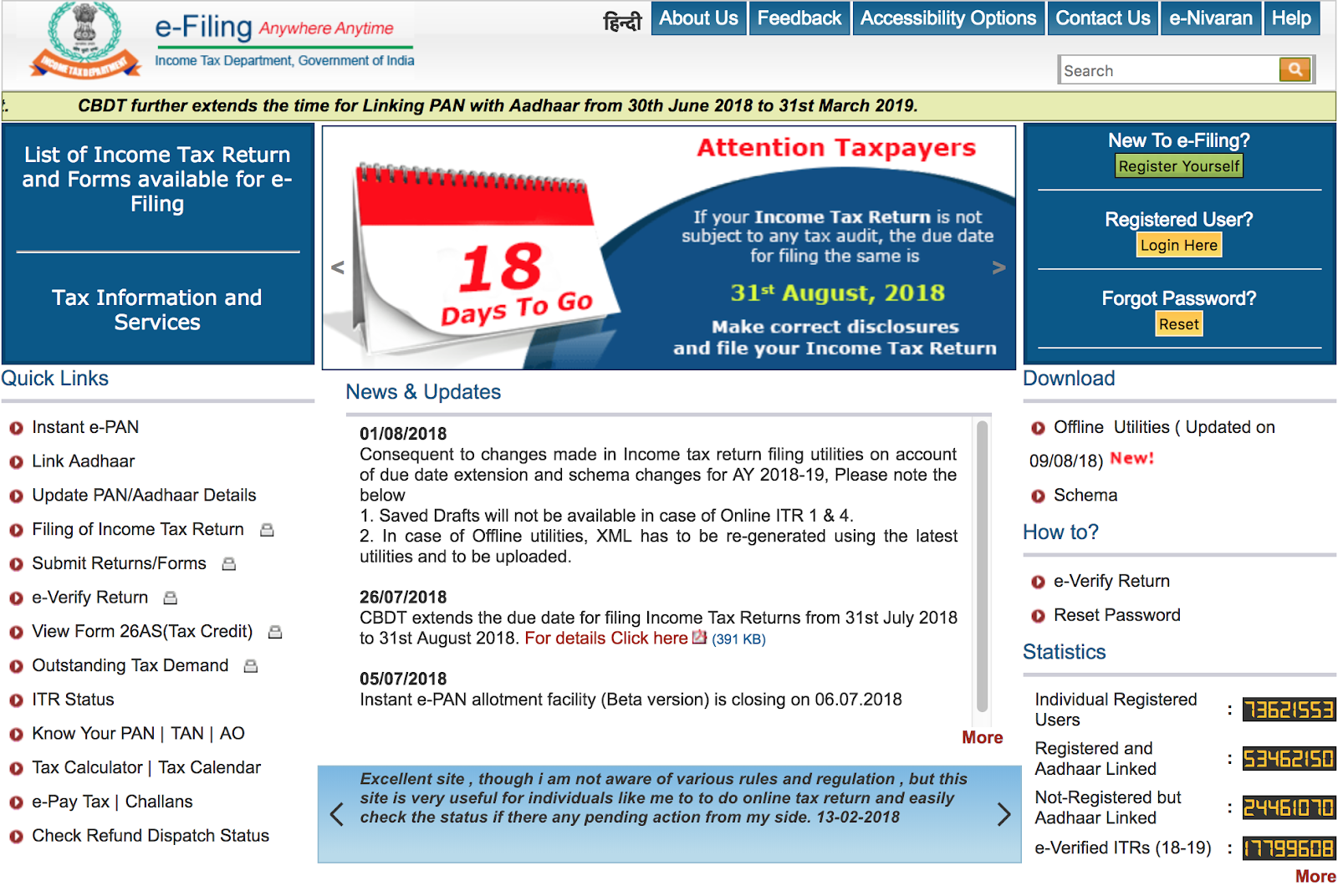

Registering your credentials with the TRACES website is not mandatory to view the form, you can also view the form if your account number is linked with any of the authorized banks.TDS TRACES is an online application of the Income Tax Department. You can view form 26AS from TRACES website. You can view form 26AS without even registering with net banking facility. How to view form 26AS without registering Viewing the form is more convenient with netbanking Any person with a PAN card and who has an account with any of the authorized banks can use this service for free of cost. An employee can also use the netbanking facility to view 26 AS.Choose the format in which you want to view the form.Click on the link at the bottom of the page.Give confirmation to be redirected to TDS-CPC website.Login to the account using PAN details, password, date of birth or date of incorporation.Visit the e-filing income tax website, i.e, and locate the form 26AS on the website.An employee needs to follow these steps in order to view form 26AS: TRACES or TDS reconciliation analysis and correction enabling system facility: The taxpayer needs to register with the TRACES in order to use the facility.Part C contains the details of direct taxes paid by the taxpayer, advance tax and self-assessment tax How to view form 26AS

Part B contains the details of the seller and tax collected at source (TCS) on the selling price of a commodity. It contains details of the deductor along with the details of the tax amount which is deducted. It contains the details of all the taxes that are deducted at the source, whether it is salary, pension income or interest income. Part A contains details of tax deducted at source. Details of annual information report transactionsįorm 26AS consists of three parts - A, B and C.Details of tax deposited by the taxpayers like advance tax, self-assessment tax, regular assessment tax.Tax deducted by the deductors on behalf of the taxpayers.

Form 26AS is linked with PAN details and the details in form 26AS are listed below

Form 26AS also contains the details of tax deducted at source, tax collected at source, advance tax and high-end transactions. It is an official form that contains tax-related information of the taxpayer.

0 kommentar(er)

0 kommentar(er)